Enhance YourFiserv GalaxyExperience with IMMeSign

Enhance YourFiserv GalaxyExperience with IMMeSign

The Premier eSignatures& Digital Transaction Solutions.

The Premier eSignatures & Digital Transaction Solutions.

IMM is proud to offer our flagship eSignature and eTeller solutions that are fully integrated with the Galaxy core financial system.

IMM’s eTransaction solutions, when used with the Galaxy environment, allow Credit Unions to deliver enhanced and engaging member experiences. Providing advanced eSignature and eTransaction management capabilities, IMM’s technology seamlessly integrates with the Galaxy core system. Like hundreds of other credit unions, Galaxy credit unions can now benefit from a totally electronic processing environment that eliminates paper while driving compliance and security enhancements.

We invite you to spend a moment and learn how IMM’s eSignature and eTeller solutions can enhance the value, service, and innovation you bring to your members and your markets.

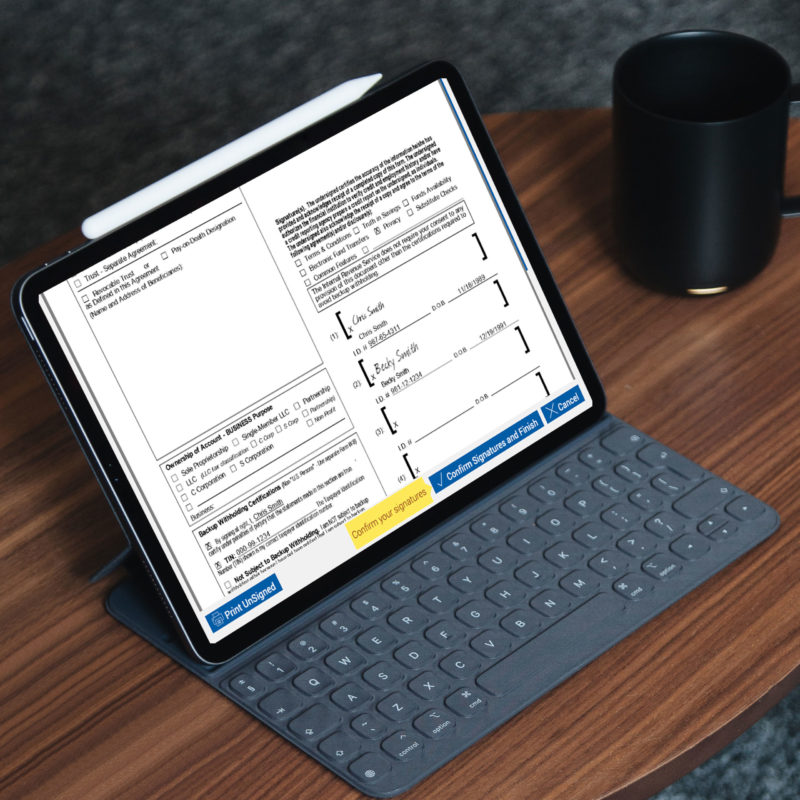

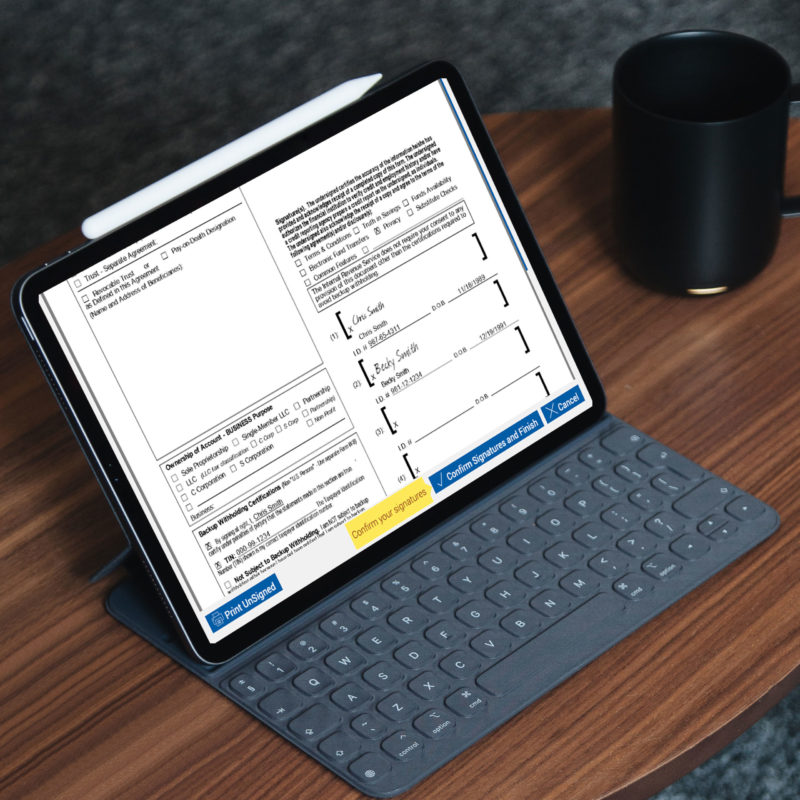

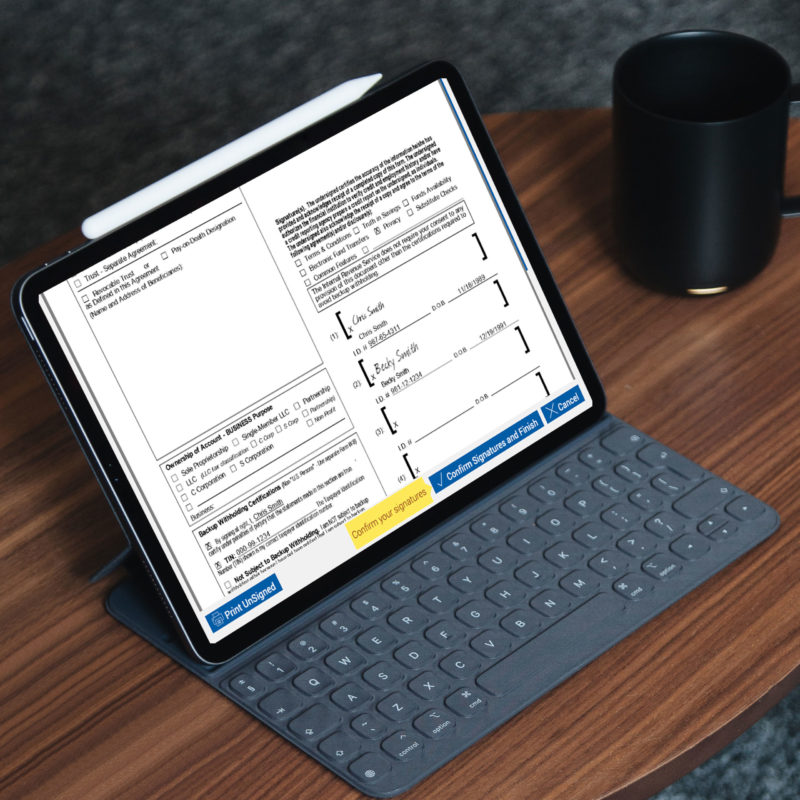

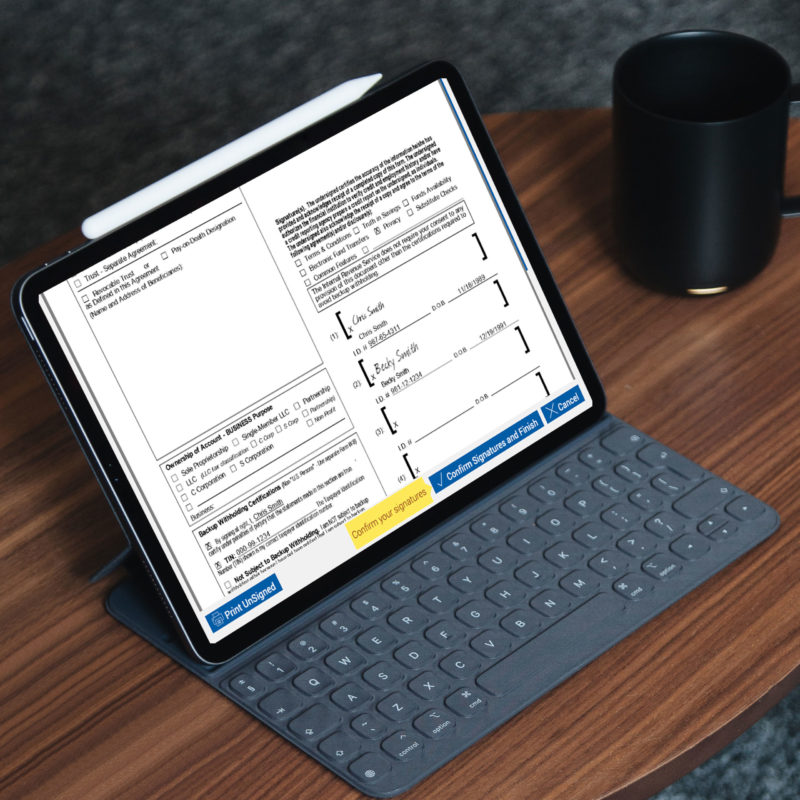

Advanced eSignatures.

IMM’s flagship eSignature solution, IMM eSign, works seamlessly with the Galaxy core system. IMM eSign accepts documents from Galaxy transactions and facilitates a comprehensive, end-to-end electronic processing environment. Members can easily and securely eSign documents at a place and time that is convenient for them. Completed documents, along with compliance audit trails, are securely archived as fully-indexed PDFs into your Imaging/ECM repository.

IMM eSign+, enhanced with workflow technology, further elevates eSignature transactions by using business rules, specific to your credit union, to ensure that all transactions occur within regulatory requirements and/or institutional operating procedures.

Advanced eSignatures.

IMM’s flagship eSignature solution, IMM eSign, works seamlessly with the Galaxy core system. IMM eSign accepts documents from Galaxy transactions and facilitates a comprehensive, end-to-end electronic processing environment. Members can easily and securely eSign documents at a place and time that is convenient for them. Completed documents, along with compliance audit trails, are securely archived as fully-indexed PDFs into your Imaging/ECM repository.

IMM eSign+, enhanced with workflow technology, further elevates eSignature transactions by using business rules, specific to your credit union, to ensure that all transactions occur within regulatory requirements and/or institutional operating procedures.

eTeller Solutions.

Our Teller item capture solution takes Check 21 processing to the next level. Paper checks get truncated directly at the teller window during the original deposit transaction. Transaction data collected during the deposit check(s) scan is seamlessly uploaded to the Galaxy core system. With the available fraud and loss module, risk traditionally associated with deposited checks is dramatically reduced, enabling expedited funds availability.

IMM’s dynamic electronic check solution, IMM eChecks, produces laser-generated Official, Starter, or Temporary Checks and seamlessly integrates with the Galaxy core system. Auto-completed official signatures can be applied to checks based on business rules. Completed Check copies are securely archived, as fully-indexed PDFs, into your Imaging/ECM repository enabling easy retrieval, research, and viewing.

IMM’s dynamic electronic receipt solution, IMM eReceipts produces electronic receipts from the Galaxy teller transactions that can include member signatures captured on tablet devices or traditional signature pads. Receipts can be thermally printed or emailed to members in security masked PDF formats. Completed eReceipts are securely archived, as fully-indexed PDFs, into your Imaging/ECM repository enabling easy retrieval, research, and viewing.

eTeller Solutions.

Our Teller item capture solution takes Check 21 processing to the next level. Paper checks get truncated directly at the teller window during the original deposit transaction. Transaction data collected during the deposit check(s) scan is seamlessly uploaded to the Galaxy core system. With the available fraud and loss module, risk traditionally associated with deposited checks is dramatically reduced, enabling expedited funds availability.

IMM’s dynamic electronic check solution, IMM eChecks, produces laser-generated Official, Starter, or Temporary Checks and seamlessly integrates with the Galaxy core system. Auto-completed official signatures can be applied to checks based on business rules. Completed Check copies are securely archived, as fully-indexed PDFs, into your Imaging/ECM repository enabling easy retrieval, research, and viewing.

IMM’s dynamic electronic receipt solution, IMM eReceipts produces electronic receipts from the Galaxy teller transactions that can include member signatures captured on tablet devices or traditional signature pads. Receipts can be thermally printed or emailed to members in security masked PDF formats. Completed eReceipts are securely archived, as fully-indexed PDFs, into your Imaging/ECM repository enabling easy retrieval, research, and viewing.

Frequently Asked Questions

What IMM solutions have been integrated with our Corelation Keystone system?

IMM’s eSignatures, eTeller Check21, and eCheck solutions are fully integrated with the Corelation Keystone system. This allows transactions to flow seamlessly and completely between Keystone and the corresponding IMM eSignature and eTransaction solution.

Because of our unique integration capabilities, employees do not have to drag and drop signature fields onto documents to set up or define the eSignature transaction. Our technology manages all of the signer assignments and field setup automatically without any manual intervention. This eliminates the potential for error and increases the overall quality of your eSignature transaction.

I am interested in eSignatures. What devices do you support for members to use to eSign their documents?

Our eSignature solution, IMM eSign, provides for both in-person as well as remote (cloud-based) signature capabilities. For In-Person signing, members can sign documents using traditional signature pads, tablet devices (iOS and Windows-based tablets), touch-enabled monitors, and even standard desktop PCs using our “Type to Sign” technology. For remote signing, virtually any device, using any operating system (including smartphones) can be used to view and sign documents remotely.

Can you support having both in-person signatures and remote signatures used when there are multiple signers on a transaction?

Absolutely. IMM eSign supports what we refer to as a “blended” signature. This delivers the ultimate consumer convenience options. With blended signatures, one borrower (for example) can sign in person, and then the co-borrower can sign remotely. Both individual signature types are applied to the same source documents and all audit controls are maintained across each individual signature ceremony. Note: IMM also supports both parties signing in-person, or both parties signing remotely. Blended signatures are just one more value-added option provided by IMM’s unique eSignature technology.

We would like to place forms on our website for members to access, complete and sign as required, such as an address change or stop payment form. Does your technology support that capability?

Can your eSignature solution support the processing of documents created outside of Corelation Keystone as well?

Yes. Documents from virtually any application can be submitted for in-person or remote eSigning provided they are submitted in an industry-standard format (e.g. Microsoft Word, Adobe PDF, etc.). This allows you to utilize our technology as an enterprise-wide eSignature solution across all operating areas of the credit union.

I see a mention of workflow in your eSignature capabilities documentation. Is this separate from workflow that may be provided or used in our business systems or Imaging/ECM system?

Yes. Our workflow technology only applies to our eSignature transaction processing. The add-on workflow module allows business rules to be established that govern the flow and requirements of the eSignature transaction. This module elevates regulatory compliance initiatives and enforces that the transaction follows your established standard operating procedures.

How do our completed document and checks get stored into our Imaging/ECM system? What systems do you support?

All completed documents and checks are generated in fully-indexed and encrypted, industry-standard PDF file formats. This means that the items are easily stored without manual scanning or indexing into your Imaging/ECM system. By storing in native PDF format, it also means that you can view the documents easily using native document viewing capabilities. IMM supports storing of fully-indexed PDFs into virtually any Imaging/ECM solution that is used in the financial services industry.

Seeing is Believing.

Over a thousand Financial Institutions have chosen IMMeSign to be their eSignature and Digital Transaction Management solution of choice. Allow us to share a moment with you so you can see for yourself why IMMeSign is simply the best solution for financial institutions. We love sharing our solution story and would be happy to give your team a personalized demonstration at your convenience.

Seeing is Believing.

Over a thousand Financial Institutions have chosen IMMeSign to be their eSignature and Digital Transaction Management solution of choice. Allow us to share a moment with you so you can see for yourself why IMMeSign is simply the best solution for financial institutions. We love sharing our solution story and would be happy to give your team a personalized demonstration at your convenience.